A Deferred Expense Can Best Be Described as an Amount

Some are considered current assets if they are used fully within a year. Deferred expense and prepaid expense both refer to a payment that was made but due to the matching principle the amount will not become an expense until one or more future accounting periods.

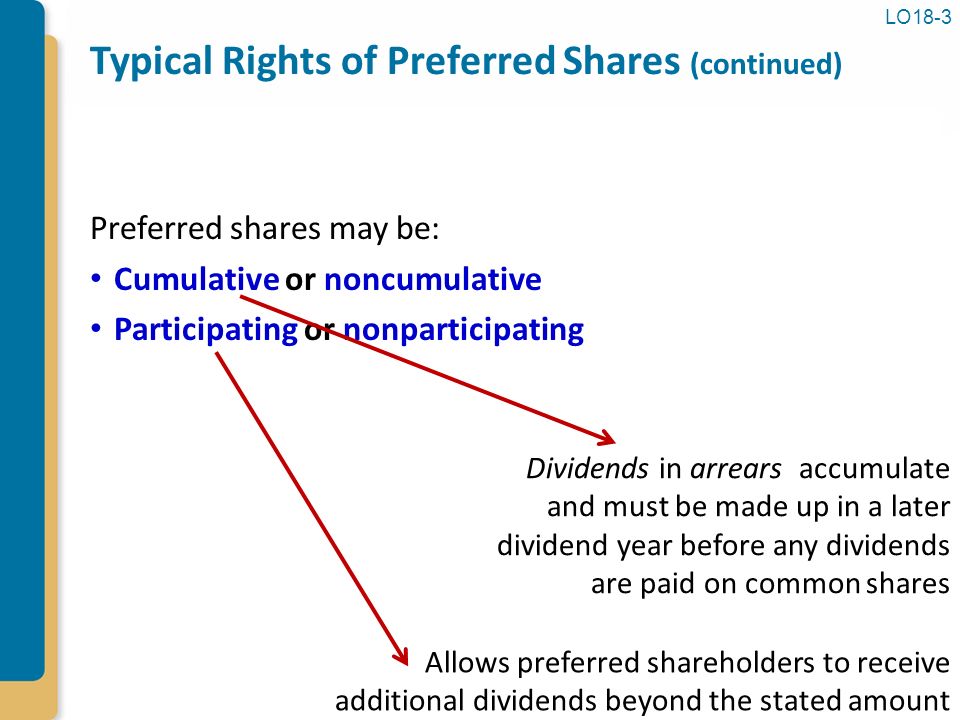

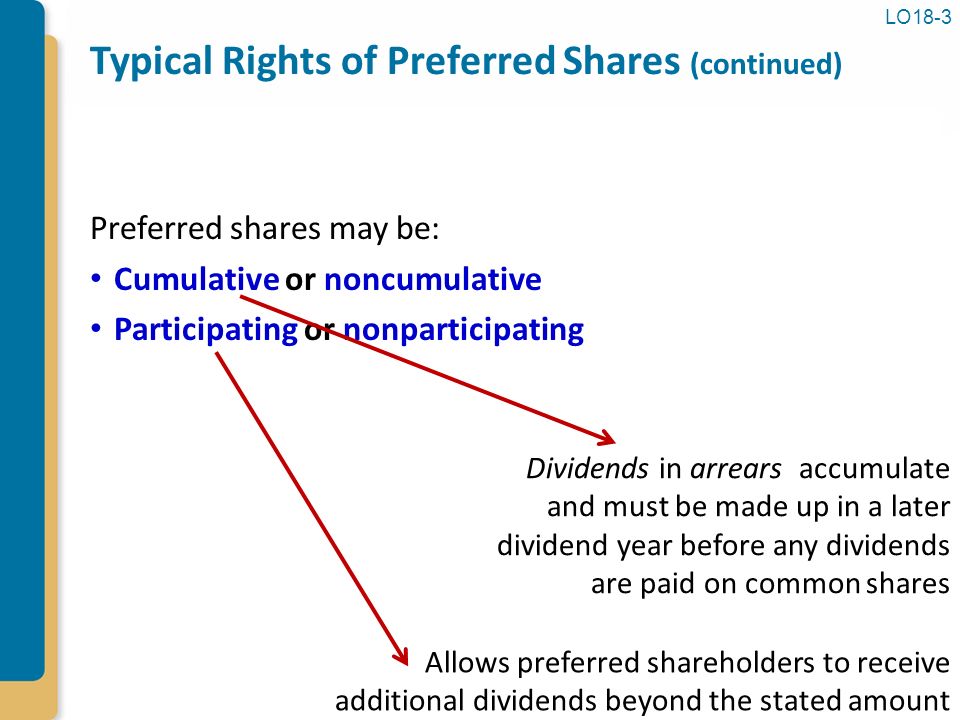

Shareholders Equity Chapter 18 Ppt Download

Allen withdrawal of 1750.

. Odessa Corporation reported 721 million income tax expense in its income statement while the actual amount of taxes paid was S651 million. A deferred expenditure is placed on the balance sheet as an asset since it is something that has been paid a certain amount for but has not yet been used in its entirety. Which of the following best describes the impact of the transactions in Odessas balance sheet.

Deferred expenses also called prepaid expenses or accrued expenses refer to expenses that have been paid but not yet incurred by the business. A prepaid expense can best be described as an amount. Terms Similar to Deferred Expense.

A deferred expense is also known as a prepaid expense. Instead they are recorded as an asset on the balance sheet until the expenses are incurred. As the expenses are incurred the asset is decreased and the expense is recorded on the income statement.

Definition of Deferred Expense A deferred expense refers to a cost that has occurred but it will be reported as an expense in one or more future accounting periods. The cost is recorded as an asset until such time as the underlying goods or services are consumed. Most of these payments will be recorded as assets until the appropriate future period or periods.

This type of expense represents an. B A prepaid expense can best be described as an amount paid and not currently matched with earnings. Objectives of financial reporting.

Answer A is incorrect because it is not matched with earnings until it is expensed in future years. An intangible asset cost that is deferred due to amortisation. External events do not include.

When a corporation pays a note payable and interest. When a business pays out cash for a payment in which consumption does not immediately take place or is not. Paid and not currently matched with earnings.

The cost incurred to register the issuance of a debt instrument. The cost of an intangible asset that is charged to expense over its useful life as amortization. Before a balance sheet is.

Deferring them takes them out of expenses and creates an asset on the balance sheet. To accomplish this the deferred expense is reported on the balance sheet as an asset or a contra liability until it is moved from the balance sheet to the income statement as an expense. 4 A common set of accounting standards and procedures are called A.

A deferred expense is an asset that represents a prepayment of future expenses that have not yet been incurred. Common prepaid expenses may include monthly rent or insurance payments that have been paid in advance. A deferred income is an amount collected and currently matched with expenses.

Not collected and currently matched with expenses. Deferred expenditure in practice. Accounting for Deferred Revenue.

Not paid and currently matched with earnings. An unearned revenue can best be described as an amount a. Deferred debit is best described as a prepaid expense.

An accrued expense is an amount not paid and currently matched with earnings. In this case the cost of the interest is a deferred expense. Generally accepted accounting principles.

Deferred expenses are those that have already been paid but more properly belong in a future period. Without deferral these expenses would be recorded on the income statement and would reduce net income in the current period. Up to 25 cash back 3 When an item of expense is paid and recorded in advance it is normally called an A.

At that point the cost is charged to expense. Tangible asset depreciation costs. Further the Current Values configuration of the Deferred Expenses such as the Currency Residual Amount to Recognize and the Deferred Expenses Amount can be defined.

Consisted of five pairs of debit and credit columns. Deferred expenses also known as deferred charges fall in the long-term asset category. The journal entry to record a prepaid expense involves an asset account and crediting cash.

AFees Earned and Cash BWages Expense and Cash CAccounts Payable and Cash DRent Expense and Cash. Additionally the Depreciation Method configurational aspects of the Deferred Expenses such as the Number of Recognitions and the duration of the Depreciation should be defined. It is a service or good that someone pays for but doesnt necessarily use right away.

A deferred expense is a cost that has already been incurred but which has not yet been consumed. Like deferred revenues deferred expenses are not reported on the income statement. Collected and not currently matched with expenses.

Accounting for Deferred Expenses. The cost of a fixed asset that is charged to expense over its useful life in the form of depreciation. Increase deferred tax liabilities by 70 million b.

Collected and currently matched with expenses. For example assume a company enters into a legal services contract that requires an upfront payment of 12000 for a year of services. Deferred revenue also known as unearned revenue refers to advance payments a company receives for products or services that are to be delivered or performed in the future.

An accrued expense can best be described as an amount A. The asset is deferred to and expensed in future years. The worksheet for Sharko Co.

Sometimes these amounts are referred to as prepayments. A prepaid expense is an amount paid and not currently matched with earnings. Deferred expense is generally associated with service contracts that require payment in advance.

For part h which two accounts are affected. An accrued income is an amount not collected and currently matched with expenses.

Ch01 Solution W Kieso Ifrs 1st Edi

Bonds And Long Term Notes Chapter Ppt Download

Download Promissory Note Template 12 Notes Template Lesson Plan Template Free Promissory Note

No comments for "A Deferred Expense Can Best Be Described as an Amount"

Post a Comment